Contents

Hence, statement 3 is incorrect.These gradations are in decreasing order of liquidity. M1 is the most liquid and easiest for transactions whereas M4 is the least liquid of all. M3 is the most commonly used measure of the money supply. Both central and commercial banks are the main source of money supply in any economy.

The circulating money involves the currency, printed notes, money in the deposit accounts and in the form of other liquid assets. However, accumulations of the government of India and commercial banks do not constitute such deposits. What makes money supply of utmost importance is the fact that it regulates the growth of an economy. An increase in the money supply brings down the interest rates, which leads to a rise in investments by the people.

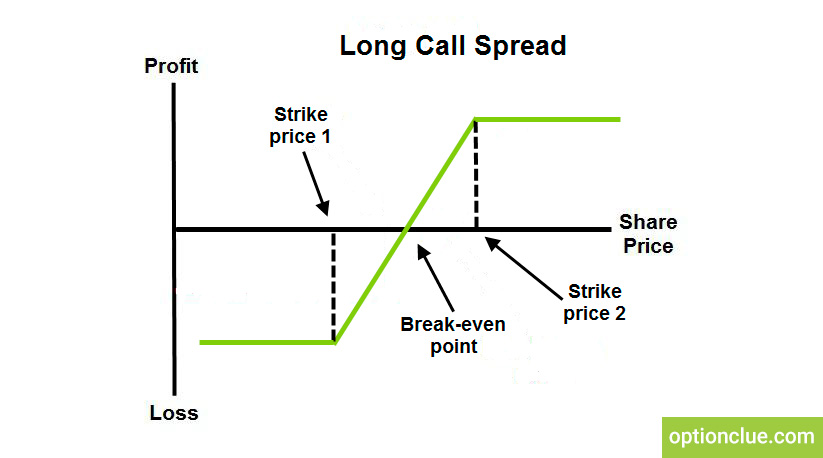

The increase or decrease in the money supply affect many macroeconomic parameters. A significant effect can be witnessed in the interest rates and inflation. The money supply in the economy is sometimes represented by a monetary aggregate known as ‘wide money,’ also known as M3. A rise in the money supply will reveal its effect by decreased interest rates and price values of commodities and services. Whereas a decrease in money supply will result in increased interest rates, price values with a coupled increase in banks’ reserves.

Measure is a broad concept and is also known as – aggregate monetary resources of the society. The money supply is the total value of money available in an economy at a point of time. Save taxes with ClearTax by https://1investing.in/ investing in tax saving mutual funds online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download ClearTax App to file returns from your mobile phone.

Current Affairs

The below mention graph represents RBI`s policy stance and its impact on the money supply in the economy. With the supply of money remaining constant, an increase in demand for money will give banks more possibilities for lending money. As a result, because there are more consumers for the same amount of money, banks will lend money at a higher rate of interest in order to earn more money. Measuring the money supply has demonstrated that there are correlations between it and inflation and price levels in the past. However, after 2000, these correlations have become more volatile, decreasing their usefulness as monetary policy guidance. Although money supply metrics are still commonly utilised, they are just one type of economic data collected and reviewed by economists and the Central Bank.

Monetary aggregates are the measures of the money supply in a country. The existence of liquid money supply, be it long-term or short-term, will usually have a direct impact on its economic health. Due to the developments in the economy and finance industry, there is an uncoupling of that direct relation. The term ‘Narrow Money’ is derived from the fact that M1/M0 are the narrowest or most restrictive types of money that form the basis for an economy’s medium of exchange. The money supply has long been thought to be an important element in determining macroeconomic performance and business cycles.

The money supply is the total amount of money in circulation in a given economy at any given time. In this article, we will understand the meaning of money supply, circulation of money and money aggregates. Liquid products as well as long-term bank deposits of $100,000 or more and institutional money-market funds. OD represents the other types of deposits made in RBI, like deposits from public sector financing, foreign banks, or international institutions such as the IMF. However, the savings and current account deposits decreased by 8%. Gross capital formation also fell by 7% in the March, 2020 quarter.

Central Bank Money vs Commercial Bank Money

A decrease in the money supply will have the opposite impact. Thus, its management becomes an essential requirement for achieving economic development and price stability. Analyzing the money supply from time to time helps economists to develop appropriate fiscal policies.

- For example, from Rs.100 can be multiplied by 5 to generate Rs.500 money supply if Reserve Ratio is 1/5 (20%) or when Money Multiplier is 5.

- Many definitions of money supply have been given and many measures have also been developed based on them.

- Therefore, in addition to civil interaction, we expect commenters to offer their opinions succinctly and thoughtfully, but not so repeatedly that others are annoyed or offended.

- M3 includes Currency in Circulation and Checkable Bank’s Deposits.

Thus, it is conventional to describe a country’s monetary system in terms of its standard money, which serves as the primary source of supply. It should be mentioned that the adoption of a specific monetary standard in a country at a given moment is determined by the country’s economic conditions. The total stock of money in circulation among the public at a particular point in time is called money supply.

Income Tax Filing

If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse. It is the total value of the currency that has ever been issued by the Reserve Bank of India minus the amount that has been withdrawn by it. Money Supply can be defined as the money circulating in an economy. A trusted mentor and pioneer in online training, Alex’s guidance, strategies, study-materials, and mock-exams have helped many aspirants to become IAS, IPS, and IFS officers. Call/Term borrowings from ‘Non-depository’ financial corporations by the Banking System.

M3 money supply increased by 6.7% in the first five months of 2020 compared with the same period last year. Money Supply is measured and expressed using different monetary aggregates like M1, M2, M3, M4 etc. It is similar to currency and coins in possession of the public since people readily accept it as a means of payment. It consists of paper notes and coins in possession of the public.

- RBI publishes figures for four alternative measures of money supply, viz.

- A contractionary strategy, on the other hand, would include the sale of Treasuries, removing money from circulation in the economy.

- It is fascinating to imagine a world where the money wouldn’t exist.

The entire amount of cash in circulation includes non-bank deposits with a commercial bank. Measure the broad money by including other forms of savings. The money supply, meaning the total cash advantage of break even analysis present under a nation’s economy, is bound to influence the economics of the market. Therefore, any change in the demand and supply of money will result in a consequent change in the market.

Why is the currency in circulation a liability to RBI or government?

It is because its components are more of a store-of-value than readily acceptable for exchange. National Savings Certificate , a savings bond for savings on income tax, is subject to exclusion. Deposits held by the banks on behalf of the other banks do not constitute such demand deposits. Another name it is known by is Fiat money which means that currency and coins serve as a medium of exchange on the government orders.

- The interbank deposits, which a commercial bank holds in other commercial banks, are not to be regarded as part of the money supply.

- Accordingly, it limits the category to physical notes and coins and funds held in the most available deposit accounts.

- The different measures of money supply are used to do the monetary analysis and to make right monetary policy for economic growth and development.

- It is generally believed that the time deposits serves as a store of value and shows the savings of the people.

M4 includes all components of M3 and total deposits with Post Office Savings Organization. This excludes the contributions made by the public to the national saving certificates. Demand deposits of foreign central banks and foreign governments.

Congrats! You are at the right place – ClearIAS!

To understand this scenario, we must learn the interplay of currency, reserve money and money supply. Central bank money – obligations of a central bank, including currency and central bank depository accounts. It is because the savings deposits with the post office saving banks are not as easy to convert into cash. Measure of the money supply and net time deposits with the banks. Time deposits are those deposits that have a specified period of term for maturity and interest rates. Central bank money – obligations of a central bank, including currency and central bank depository accounts.

The interbank deposits, which a commercial bank holds in other commercial banks, are not to be regarded as part of money supply. The narrow money is composed the currency with the public, demand deposits of the public with the banks and other deposits of the public held with the Reserve Bank of India. Another measure of money supply is M3 which includes both M1 and time deposits held by the public in the banks. Reserve money is also called central bank money, monetary base, base money, or high-powered money.

Number of times money passes from one hand to another, during given time period. In other words, when Reserve money increases, Broad money will also increase. Poor disposable income decreases the demand for commodities and results in deflation and gradually results in recession. This hinders borrowing and spending reducing investments and disposable income in the hands of consumers. This stimulates spending by generating more investment and putting more money in the hands of consumers.