Blogs

Although not solutions it will not shell out me personally and so i log off and you will return later on. I’ve had some good victories right here to the free revolves, to play $step one.50 a bet, which i usually do not start about this unless of course We got a big winnings in the other game and you can already been here. The major red piggy that appears quickly either because the an advantage round can be so adorable!

Can i have more than just you to examining otherwise checking account?

However they can afford advisors to help them do and you may manage the property. If were not successful bank’s deposits try thought by the proper lender, the brand new part practices always reopen the following business day. In the event of a depositor rewards, the newest FDIC will be sending a letter for you advising your away from the brand new closing. The newest letter tend to instruct your about precisely how you can remove the belongings in the container. Use of the brand new safe deposit boxes is typically provided on the safe deposit proprietors next working day following closure.

An advantage was a good perk, nonetheless it shouldn’t end up being the main reason for selecting a financial. It’s crucial that you come across a lender that fits yours financial habits and wants. In case your Federal Reserve chooses to lessen the set aside proportion thanks to a keen expansionary economic policy, industrial financial institutions must keep less overall on hand and you may are able to increase the level of financing to give people and you may organizations.

Public

You’ll found details about the newest inspections and deposit slips out of the newest getting financial. The fee will likely be prevented with the Fifth Third More time ability, that provides more time to make a deposit to cover the overdraft and you can prevent the cost. The brand new put to cover the overdraft should be from midnight the next business day. Customers away from Funding You can obtain paychecks early from the starting a great 360 Checking focus-results membership and signing up for lead put. A simple solution to de-chance the investments is to always’lso are varied inside the carries, bonds and cash, instead of huge bets on the risky groups, ties or possessions. Talking about a financial investment organization you to definitely participates inside CIPF contributes various other coating out of defense.

What goes on on the lead places if the lender fails depends to your future of your hit a brick wall bank. If the other financial gets control, your own head dumps have a tendency to immediately redirect for the the new bank vogueplay.com advantageous link . If there’s zero acquiring financial, then the FDIC will attempt to find a business so you can temporarily handle direct dumps, generally so Public Defense readers do not sense any delays. Affected consumers might possibly be up-to-date in the any changes to their lead dumps.

We’re compensated in return for keeping backed services features, otherwise from you simply clicking specific backlinks posted for the the web site. Therefore, that it compensation get effect just how, in which as well as in what purchase issues appear in this list categories, but in which blocked legally for our home loan, family equity or any other house financial loans. Other variables, such our own exclusive site laws and regulations and you can if or not something exists close by or at your thinking-picked credit score variety, can also impression how and you may where points appear on this site. Even as we make an effort to offer a variety of also provides, Bankrate does not include information regarding the monetary or borrowing from the bank tool otherwise provider. Early head put is going to be a good tool to produce payments on time and steer clear of relying on overdrafts or borrowing from the bank.

Merely instant added bonus?

The fresh Fed improved the rate four times inside the 2023 and you can seven times inside 2022. Of many pointed out that they always turn-down their illumination just before examining their bank account. Cds is handled from the FDIC like other bank accounts and you may will be covered to $250,one hundred thousand if the financial is a member of one’s service. When you have numerous Cds around the some other associate financial institutions, per will be secure around one to restrict. However the previous local financial turmoil might have your worried about your investment in case there is a lender failure. She struggled to obtain almost two decades because the a professional, leading multi-billion-dollar mortgage, mastercard, and deals profiles having surgery international and you can another focus on the consumer.

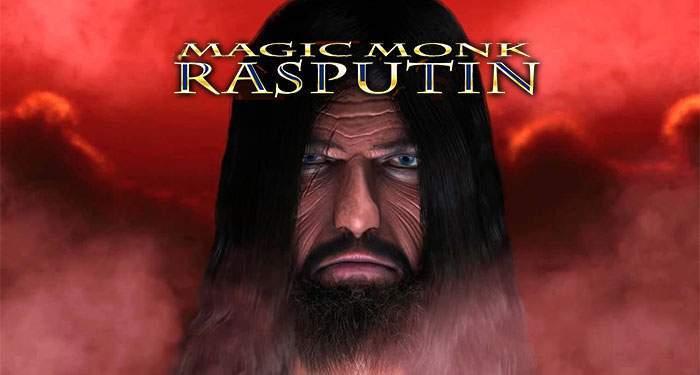

Next ‘s the autoplay function that you can use whenever you aren’t from the feeling to own yourself spinning the overall game. Besides this is the choice option that enables you to definitely to improve the choice dimensions. Once ‘s the win button that can tell you extent of cash you have made after each and every effective twist. The last ‘s the twist button which you use once you have to yourself twist the new reels. Immediately after playing each one of these unbelievable bank and robbers stories, you might have dreamed regarding the taking part in a Heist. There is an issue even if, draw from an excellent heist in the real life is unsafe and you also may end upwards in the prison.

Characteristics

When a bank goes wrong, this may try to borrow money off their solvent banking companies so you can shell out their depositors. Should your a deep failing financial never pay the depositors, a bank worry you are going to occur, causing depositors so you can withdraw their money on the financial (also known as a lender work at). This will improve situation even worse on the faltering lender by the shrinking its liquid assets. Whenever a good bank’s property drop off, it offers less cash in order to lend so you can individuals. A bank goes wrong whether it is also’t satisfy its financial obligations in order to creditors and you can depositors.

Policy & Societal Attention

Compared with other offers to the the list, which offer means a lengthy commitment to increasing your balance, however the incentive amount is actually decent as well as the practice-building practice of protecting each month might possibly be far more worthwhile. Which bonus give is a good solution if you would like a bank account from the one of the largest financial institutions from the U.S. The newest savings account bonus is actually ample compared with the new put needs, particularly when stacked facing comparable also offers on the all of our checklist. Delight in around a good $step three,100000 incentive when you unlock a new Pursue Individual Consumer Checking℠ account having being qualified things. Within forty five days of discount enrollment, import being qualified the fresh currency or securities in order to a variety of qualified checking, discounts and/or J.P.

Bad banking institutions tend to buy the illiquid property and bad finance from the newest weak entity. Heroin dependency contributed DeGraw to a drug household in the Broome County, where police arrest records state she fulfilled Marlon Graham, a Binghamton-urban area resident having a back ground inside the a house transformation and you can team asking whom turned entangled from the medicine change. What used, government prosecutors say, are a “profitable conspiracy” between the two inside trafficking from meth, heroin and you can fentanyl across the course of from the five months up to November 2018. Discover the outlined book on the in charge playing techniques here. Roy Hodgson ‘s the fresh favorite on the latest sack competition to play.

While the FDIC will offer solution-because of deposit insurance policies to the genuine manager(s) away from a great fiduciary put the new FDIC cannot pay the deposit insurance coverage to proprietors or users. As an alternative, the fresh FDIC will pay the fresh deposit insurance rates to the fiduciary. Consequently, the new fiduciary was responsible for submitting the new deposit insurance policies costs to their customers.

The brand new FDIC doesn’t attempt to watch the fresh matchmaking anywhere between fiduciaries and you can users or the shipping out of money from fiduciaries so you can consumers. Customers are advised to contact their representatives/agents regarding the condition of the funding fund, because the FDIC utilizes those individuals parties available the required suggestions to decide insurance policies. SoFi Lender offers a slew of financing and you may funding items, and contains a mixed Checking and you may Savings account. There’s zero fee every month for the membership or harmony minimal, also it has early head put. Asterisk-Totally free Examining, the bank’s simplest savings account, does not have any month-to-month maintenance fee and no minimum deposit specifications. Huntington Advantages Examining and Huntington Rare metal Benefits Examining is actually each other attention-results checking account.